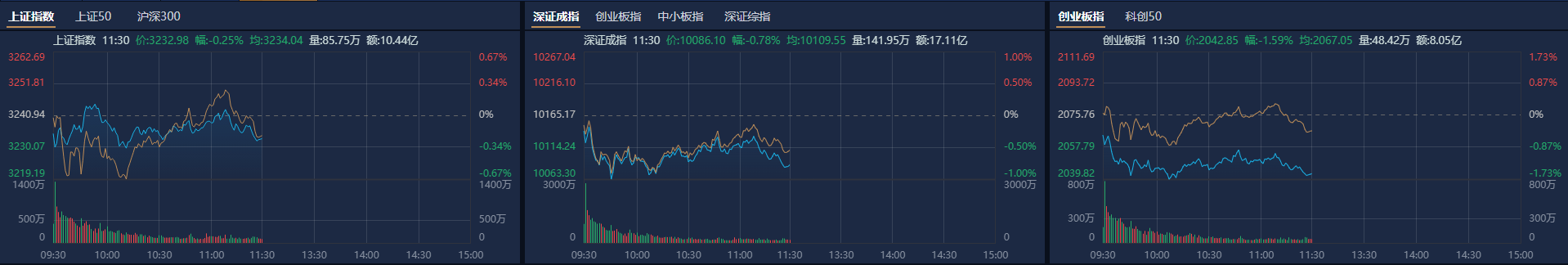

During the stock market trading on December 24th, the banking sector once again took center stage, with the four major state-owned banks—Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, and Bank of China—showing particularly strong performance, hitting new historical highs in trading. By the end of the trading day, the stock prices of these four banks had risen over 1%, with an annual increase of 47%, significantly outpacing the 92% of stocks in the A-share market.

It's worth noting that the total market value of these four banks has exceeded 7 trillion yuan, accounting for a significant portion of the banking sector's market value. At the same time, the total market value of the entire banking sector is nearly 12.2 trillion yuan, which is approximately 12.8% of the total A-share market value. Industrial and Commercial Bank of China, with its exceptional market value scale, has become the "Market Value King" of the A-share market, further widening the gap with Kweichow Moutai.

In addition to the big four banks, six other stocks also hit historical highs on December 24th. These stocks come from industries such as transportation, communication, basic chemicals, trading and retail, and mechanical equipment. Among them, stocks from the transportation sector, such as Guangdong Expressway A and WuZhou Traffic, accounted for nearly 20% of the total. From the perspectives of the main board, the GEM, and the Shenzhen Stock Exchange, the stocks hitting new highs were mainly from the main board.

Looking at the stock performance over the year, Qingmu Technology saw the most remarkable increase, with a rise of nearly 181.3%. Zhailong Interconnect and Gaoding Minbao's stock prices also doubled. Among the big four banks, Agricultural Bank of China's increase exceeded 50%, performing relatively better than nearly 79% of the banking stocks in the same period.

Despite the recent strong performance of bank stocks, from the perspective of capital flows, financing customers have been reducing their holdings. As of December 23rd, the financing balance of Industrial and Commercial Bank of China had decreased by nearly 2 billion yuan month-on-month, with a decline of nearly 8.5%. The financing balances of China Construction Bank, Agricultural Bank of China, and Bank of China also showed a decrease. Multiple bank stocks, including China Merchants Bank, Ping An Bank, and Minsheng Bank, saw their financing balances in net selling situations.

Nevertheless, stocks like Ningbo Bank, China Citic Bank, and Changsha Bank have received增持 from financing customers within the month. These bank stocks' performance may inject new vitality into the market.

暂无评论